President Donald Trump on Friday announced that Kevin Warsh will take over as chair of the Federal Reserve, replacing Jerome Powell when his term expires in May. The move closes a long and often turbulent chapter for the U.S. central bank, marked by persistent political pressure and public criticism of its leadership.

Kevin Warsh named by Trump as next Federal Reserve chair, set to succeed Jerome Powell.

The decision caps a selection process that officially kicked off last summer but had been brewing for years. Almost from the moment Powell assumed the job in 2018, Trump repeatedly attacked the Fed’s policies, accusing it of moving too slowly to cut interest rates and, more recently, criticizing cost overruns tied to the Fed’s Washington, D.C., headquarters renovation.

Announcing the pick on Truth Social, Trump praised Warsh in glowing terms. “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best,” the president wrote.

Market reaction and credibility

At 55, Warsh is a familiar figure to markets, having previously served as a Fed governor. Because of that background—and a belief on Wall Street that he would not automatically bend to presidential pressure—his nomination did not trigger major market swings.

“He has the respect and credibility of the financial markets,” said David Bahnsen, chief investment officer at The Bahnsen Group, during an appearance on CNBC. Bahnsen added that while near-term rate cuts are widely expected regardless of leadership, Warsh is seen as a steady, long-term choice.

Stock market futures dipped slightly Friday morning but recovered from earlier lows once the nomination became clear.

Confirmation and timing

Warsh must still clear the Senate confirmation process. If approved, he will assume the role in May, when Powell’s term as chair ends. He is also set to fill a Board of Governors seat currently held by Governor Stephen Miran, whose term expires this weekend, though Miran can remain until a successor is formally installed.

A possible “regime change” at the Fed

Warsh steps into the role at a moment of shifting priorities inside the central bank. Banking regulation has eased in recent years, with policymakers dialing back capital requirements, reducing supervisory staffing, and stepping away from initiatives such as climate-related stress planning for banks.

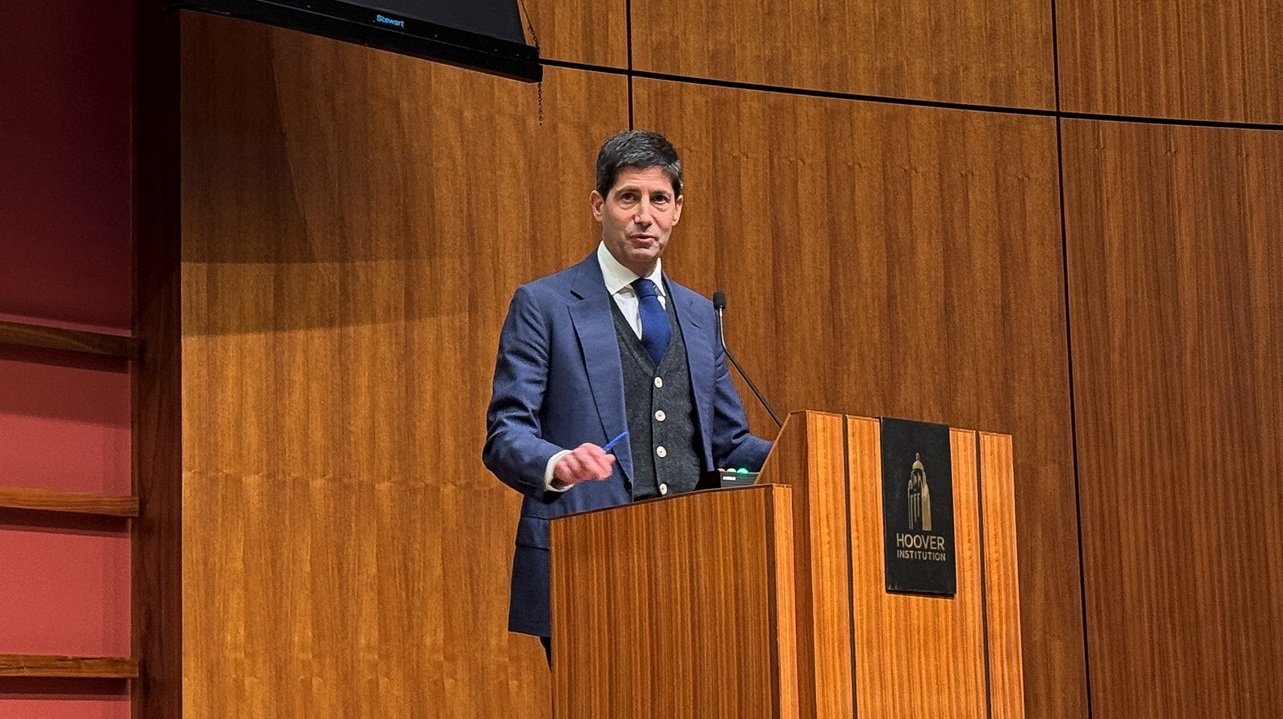

Last summer, Warsh himself suggested the Fed needed a reset, calling for “regime change” during a CNBC interview. He argued that the institution’s credibility problems stem from its current leadership—comments that could put him at odds with an organization where consensus-building is central to policymaking.

Pressure on Fed independence

Trump’s choice comes during one of the most sensitive periods for the Fed in decades. Inflation has cooled but remains above the Fed’s 2% target, government borrowing continues to climb, and political scrutiny of monetary policy has intensified.

The tension escalated recently when the Justice Department subpoenaed Powell over the Fed’s construction project. Powell responded bluntly, calling the move a “pretext” to pressure the central bank into looser policy.

Against that backdrop, concerns about Fed independence—long a cornerstone of its credibility—have moved from theory to real-world debate. Trump and his allies have floated ideas ranging from greater White House oversight to requiring the Fed chair to consult directly with the president on interest-rate decisions.

“I want to keep it nice and pure, but he certainly wants to cut rates,” Trump said Friday from the Oval Office, adding that while he hasn’t discussed rate cuts with Warsh, the issue mattered greatly in the selection process.

A crowded field narrows

Warsh ultimately emerged from a competitive slate that once included 11 candidates, ranging from current and former Fed officials to prominent economists and Wall Street executives. The interview process, led by Treasury Secretary Scott Bessent, narrowed the field to a handful of finalists.

Among those considered were Fed Governor Christopher Waller, BlackRock bond chief Rick Rieder, and National Economic Council Director Kevin Hassett. Trump publicly praised the finalists, calling them “amazing talent,” and several offered congratulations to Warsh following the announcement.

Political hurdles ahead

Despite support from parts of Congress, Warsh’s path to confirmation may not be smooth. Republican Sen. Thom Tillis of North Carolina has said he will block all Fed nominations until the Justice Department’s inquiry involving Powell is resolved.

Still, allies in the administration downplayed the obstacle, expressing confidence that the issue could be settled quickly and that Warsh would ultimately be confirmed.

The road forward

Economically, the new chair will inherit a delicate balancing act. Inflation has eased but not disappeared, the labor market is cooling, and traders expect limited movement on rates—at most two additional cuts this year before policy settles near what the Fed considers a neutral level.

There is also the unresolved question of Powell’s future. While past chairs have typically stepped down entirely after losing the top job, Powell still has two years left on his term as a governor and could choose to remain, potentially serving as a counterweight to political pressure.

As the transition unfolds, Warsh’s nomination underscores the high stakes facing the Federal Reserve—and the ongoing debate over how independent it can remain in an era of intense political scrutiny.